At-fault Celebration Does Not Have Adequate Insurance What Next?

In various other states, you can decline it in writing, or it could not be supplied in any way. Discover Progressive Responses' auto content standards to learn why you can rely on the car insurance information you discover right here. So what takes place if you choose to purchase the minimal level of obligation in your state and then overall somebody's Audi? If you are at fault in an accident you will certainly be held responsible for every one of the damages you create, whether you have sufficient insurance coverage to spend for it.

What Is Uninsured/underinsured Motorist Residential Property Damage (uimpd) Protection?

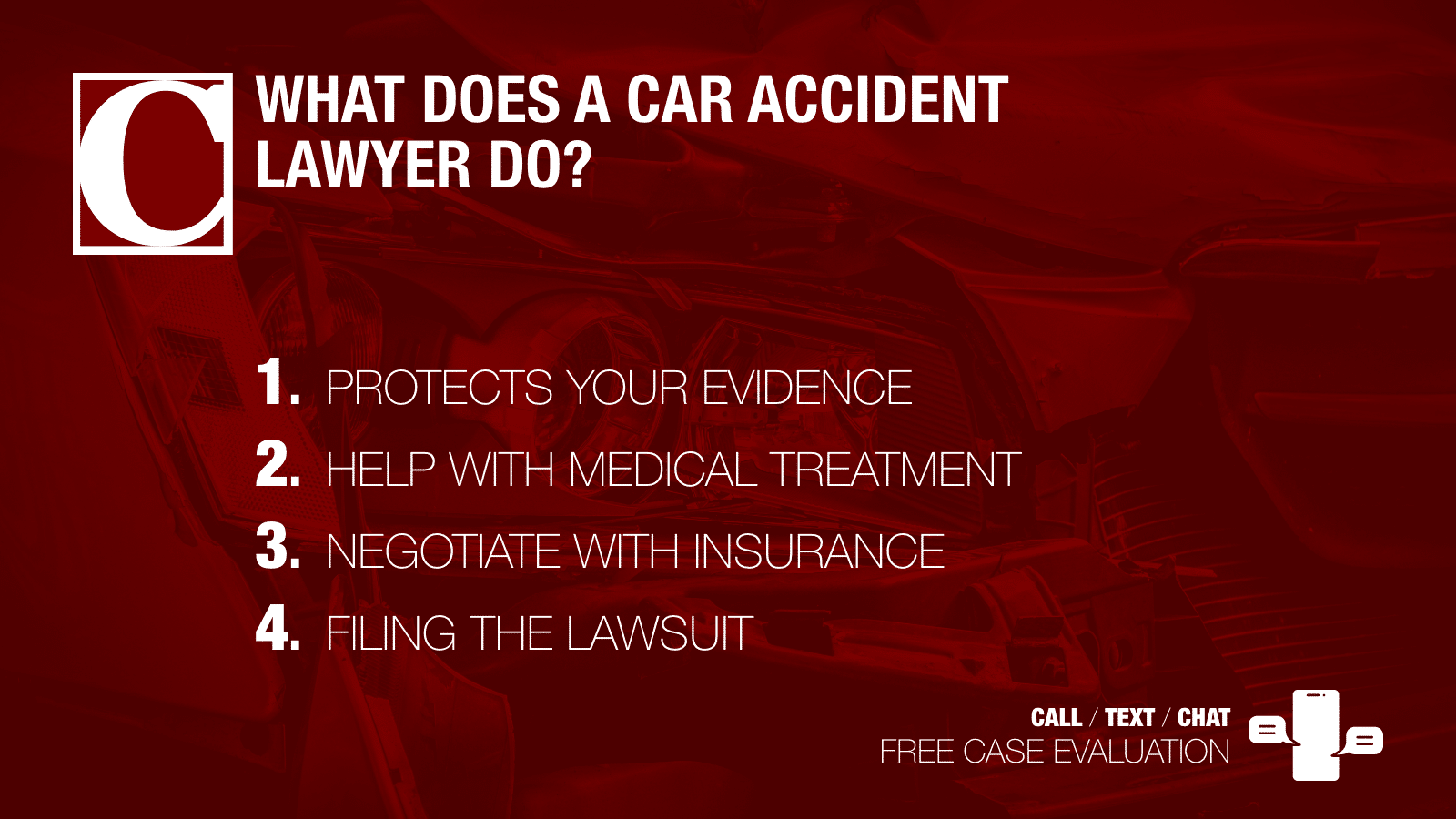

If you trigger a crash without insurance, you'll have to pay for any kind of damages. You'll also be accountable for medical bills of anybody pain, including the various other vehicle driver, travelers, or pedestrians. After an accident, it is necessary to talk with a personal injury legal representative. Driving without insurance coverage can trigger significant penalties, like losing your permit or facing big fines.

Without insurance driver coverage can likewise come in handy for benefits like lost earnings and discomfort and suffering, which medical insurance will not spend for. In this situation, you have protection for 2 vehicles under 2 separate plans, both with $100,000 in UM insurance coverage. If you're wounded when a without insurance vehicle driver strikes among your vehicles, you would stack UM advantages up to $200,000.

Noneconomic damages for discomfort and suffering and psychological distress might likewise be suitable, while those who have actually lost enjoyed ones can pursue a claim for wrongful death problems. Collision victims who are instrumental can Personal injury attorney still pursue an insurance claim against an irresponsible motorist as long as the target had not been 50% or even more to blame. Problems will simply be reduced based on their very own portion of fault. If you're facing what takes place if the individual liable in a crash has no insurance coverage, let us assist you navigate these struggling waters. This competence is particularly useful when negotiating settlements for a no-fault insurance claim, where insurance companies could attempt to reduce payments. These alternate methods can supply extra compensation to cover your losses.

Instant Actions After A Crash With An Uninsured Motorist

Accident reports must be made by drivers or law enforcement when a vehicle mishap happens in Texas. Title 7, Phase 550 clarifies the policies for reporting, which have to occur when a mishap hurts or kills somebody or causes a minimum of $1,000 in residential or commercial property damages. According to Texas Code Section 16.003, crash sufferers have 2 years from the date of the mishap to make an accident insurance claim and seek settlement from the at-fault vehicle driver. Once that two-year period has Immigration lawyer actually passed, the instance will certainly be time-barred due to the fact that the statute of restrictions will certainly have run out. In a lot of cases, one driver plainly made a mistake that caused an accident.

How To Buy Uninsured Driver Protection

- Uninsured driver coverage does not pay anything to the motorist who lacked car insurance.Adding crash and comprehensive coverage might set you back more upfront.Recognizing North Carolina's insurance requirements is essential if you are ever before in an auto crash, specifically when the at-fault driver doesn't have insurance.For example, she may have been "overserved" at a bar before creating the cars and truck wreckage.It applies if the at-fault chauffeur has insurance coverage, yet their limits aren't sufficient to cover your complete costs.These can range from a few hundred to numerous thousand dollars, depending on the state's regulations and the scenarios of the violation.

If you have just recently been in a car mishap and the other motorist does not have sufficient insurance policy coverage to pay for your injuries and damages, call our law firm today. Right Here in New york city, the statute of limitations for submitting an auto accident case is generally three years from the date of the crash. Here in New york city, there is additionally a demand for no-fault insurance coverage. This lawful requirement makes certain that medical expenses and shed incomes are covered regardless of that is at fault in an accident. Failure to comply with these regulations can lead to considerable penalties, consisting of fines and suspension of the driver's license.

Unlike some states that only mandate liability insurance coverage, New york city calls for drivers to carry a number of sorts of insurance coverage to totally safeguard versus the uncertain nature of road cases. Let's say you have protection for two cars on the exact same policy, both with $100,000 in bodily injury insurance coverage. If you're injured when an uninsured chauffeur creates an accident with one of your cars, you can "pile" protection and claim up to $200,000 in advantages. Significant injuries from an automobile crash might need substantial medical care, recovery, and even long-lasting aid. Uninsured vehicle driver insurance coverage can cover recurring medical expenses associated with these injuries, lowering the economic stress. Making certain all medical treatments and physical therapy sessions are well-documented is essential in this process. Courts can release judgments requiring payment, and if the uninsured chauffeur lacks funds, their possessions-- such as interest-bearing accounts, lorries, and even future earnings-- may undergo garnishment or seizure. Some states permit installment payment plans for court-ordered problems, but the economic pressure continues to be. An underinsured motorist case will typically take a bit longer to create, a minimum of till your clinical treatment proceeds and you get an understanding of the worth of your vehicle mishap instance. But once you believe that your case is worth greater than the defendant's responsibility protection, educate your insurance firm instantly that you plan to make an underinsured motorist case. If you are associated with an automobile crash and the at-fault vehicle driver does not have insurance, you still have choices for recovering compensation. Understanding North Carolina's insurance coverage requirements is important if you are ever in a vehicle mishap, especially when the at-fault chauffeur does not have insurance policy.